As the competitive landscape continues to evolve, organisations must employ effective corporate-level strategies to help them stand out from their competitors. But what exactly is a corporate-level strategy? And how do you go about creating one? In this blog post, we’ll be exploring the definition and meaning of corporate-level strategies and frameworks you can use to ensure your success in this arena. From understanding why such strategies are so important to examine ways to build and measure your own, there is plenty of information for business owners looking to create a winning game plan.

What Are Corporate Level Strategies?

Corporate level strategies are the ‘big picture’ plans organisations employ to reach their overarching objectives. These strategies usually span beyond one business unit or product line and focus instead on overall company goals such as growth, stability, and profitability. Examples of corporate level strategies include global expansion, diversification, mergers & acquisitions, outsourcing and cost-cutting measures.

Corporate level strategy formulation may involve a range of decision-makers, from senior executives to board members depending on the organisation’s size. Ultimately, it is up to senior leadership teams to develop effective long-term plans for reaching organisational goals in order to maximise value for stakeholders.

Types of Corporate Level Strategies

Stability Strategy

A stability strategy is a type of corporate level strategy which involves maintaining the status quo and keeping operations within existing parameters. This strategy is often adopted when an organisation has identified its core competencies and wishes to focus on them in order to increase profits or minimise risk. The stability strategy focuses on preserving the current state of business and avoiding any major changes. It also entails protecting established processes, ways of doing things and customer relationships while still striving for growth within existing boundaries.

The primary objective of this approach is to ensure that market share remains steady through effective marketing efforts targeted at existing customers while concentrating resources on strengthening the company’s competitive advantages over those held by competitors. Stability strategies may be deployed when conditions remain relatively stable but can easily become outdated should external factors suddenly disrupt the marketplace and significantly change customer demands or preferences.

Expansion Strategy

Expansion Strategy as a type of corporate level strategy is an important part of the overall corporate strategy. It involves deciding how to expand the company’s business operations and activities to achieve its long-term goals. Expansion strategies can include both internal and external growth, such as mergers, acquisitions, joint ventures and strategic alliances. It could also involve new product launches or services, entering new markets or expanding existing ones.

When considering whether to pursue a particular expansion strategy for their organisation, companies must consider factors like operational capabilities, quality assurance objectives and financial resources available before taking any action. Additionally, they need to evaluate risks associated with each option, such as market saturation in certain areas or competition from other players within the industry. Furthermore, they should ensure that all stakeholders are considered when formulating these plans so that any decisions made have unanimous approval across all sectors of the business, including shareholders and employees.

This type of corporate level strategy is extremely beneficial for businesses that wish to stay competitive while also achieving their desired results in terms of growth targets set out by management teams. Moreover, it allows organisations to capitalise on opportunities that may have otherwise been overlooked without appropriate planning, thus maximising potential profits over time due to increased efficiency levels achieved through careful analysis beforehand.

Retrenchment Strategy

Retrenchment strategy, also known as downsizing or rightsizing, is a type of corporate level strategy. It involves reducing the size and scope of an organisation’s operations to save costs and improve efficiency. Retrenchment strategies involve cutting staff and resources while streamlining processes to maximise profits without sacrificing product quality or customer satisfaction. This type of corporate level strategy is often employed when businesses are facing financial difficulty due to economic recession, change in market conditions, competition or mismanagement.

Retrenchment can be seen as a defensive measure used by companies that have identified areas where they could make cost savings but do not want to compromise on quality standards or customer service levels. Such measures usually include decreasing staff numbers through redundancy programs, closing unprofitable business units and outsourcing certain services such as IT support or accounting functions.

In addition to these measures, companies may look at restructuring their product range so that only profitable items are kept and non-essential ones removed from production in order to reduce overhead costs associated with them. Focusing solely on core activities or exiting markets that no longer offer growth potential form part of retrenchment strategies employed by organisations today to reduce operating costs and improve profitability overall.

Combination Strategy

A combination strategy is a type of corporate level strategy that involves the simultaneous implementation of two or more different strategies. Companies often use this type of strategy to increase their market share, reach new markets and customers, and gain competitive advantages. It enables businesses to expand their operations while protecting their current marketplace positions.

The main benefits associated with implementing this type of strategy are increased revenues, improved efficiency, better customer service levels and greater profitability. Combination strategies can involve:

- The utilisation of a variety of approaches, such as diversifying into new products or services.

- Integrating production processes between organisations.

- Targeting specific niche markets.

- Utilising cost-effective technologies.

- Entering international markets.

- Gaining access to key resources and personnel through strategic alliances, joint ventures or mergers/acquisitions.

- Forming strategic partnerships with other firms in related industries.

- Investing heavily in research and development projects to enhance existing products or create entirely new ones.

For a combination strategy to be successful, it must focus on the activities that will create value for stakeholders such as customers, employees, shareholders and suppliers. Additionally, it must adequately address any potential risks associated with its implementation before taking action since failure to do so may result in financial losses for an organisation instead of success.

It’s important for executives involved in developing these strategies to ensure that they align perfectly with overall business objectives. Otherwise, they could accomplish nothing but waste time and money without providing any tangible results whatsoever.

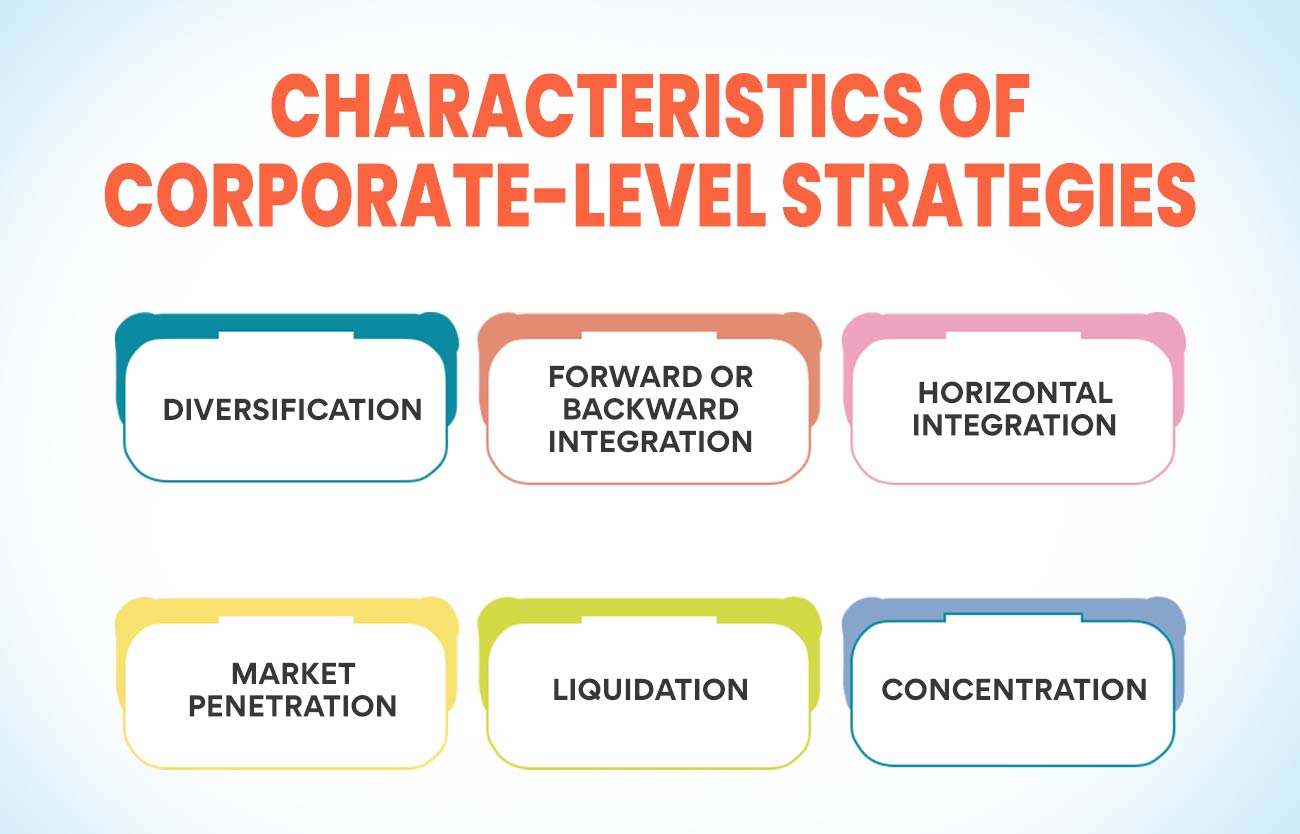

Characteristics Of Corporate Level Strategies

Diversification

Diversification

Diversification is an important and effective characteristic of corporate level strategies. It involves a company expanding its business into new markets, products or services that are unrelated to its current operations. The main objective of diversifying the company’s portfolio is to reduce risks associated with over-reliance on one area and spread the risk across multiple areas. This type of strategy allows companies to increase their revenues by tapping into new sources of income while reducing any potential losses due to market instability or other factors.

Diversification also helps businesses become more competitive in existing markets by offering different products or services that can be tailored to meet customer needs better than those offered by competitors. Additionally, diversified companies may benefit from economies of scale as they can combine resources for purchasing, production and marketing activities across multiple industries. In summary, diversification is an essential element when considering corporate level strategies and should be taken into account to maximise profits while minimising risk.

Forward or backward integration

Forward or backward integration is a type of corporate level strategy that involves either expanding business operations into a related industry or entering into an entirely new industry. Forward integration occurs when a company takes ownership and control over suppliers in its production process, while backward integration happens when it takes ownership and control over distributors in its distribution process. This can benefit companies by providing greater control over their supply chain, reducing costs and improving customer service levels.

Additionally, if done correctly, forward or backward integration can help firms to gain competitive advantage through economies of scale and scope – for example gaining access to cheaper resources or specialised knowledge from acquired companies. Ultimately, this corporate-level strategy helps organisations build operational efficiencies that could increase profitability.

Horizontal Integration

Horizontal integration is a type of corporate level strategy that involves merging or acquiring companies in the same industry (e.g. two competing automobile manufacturers). By combining operations with other firms in the same sector, businesses can diversify their product offerings while simultaneously taking advantage of cost savings from centralising production activities across multiple locations. The primary motivation behind horizontal integration is to increase market share, reduce costs through economies of scale, and gain access to new markets and customers.

Horizontal integration can also provide significant competitive advantages such as increased bargaining power over suppliers, greater control over pricing due to increased market share, more efficient use of resources and higher profits due to better economies of scale and scope.

Additionally, it allows for faster entry into new markets as one company can quickly acquire an established presence in those areas by purchasing another business already operating there. However, this strategy is not without its risks since it requires large amounts of capital investment and could lead to anti-trust issues if competitors are consolidated too much within an industry.

Also Read: Why Succession Planning Is Important & How To Strategize It?

Market Penetration

Market penetration is one of the four primary characteristics of corporate-level strategies. It involves increasing sales and market share for existing products or services within an organisation’s current target markets. This strategy can be used when a company has identified a segment in which it desires to gain more presence but does not require any new product development or diversification into new segments. The goal is to understand customer needs better and increase overall market share by making more of its products available at competitive prices.

Companies must focus on their strengths, such as research and development, product innovation, marketing campaigns and distribution networks, to implement this strategy. They should also analyse competitor pricing structures to determine how they can make the most efficient use of resources to maximise acquisition opportunities and minimise costs associated with penetrating the desired market segment.

Businesses should strive to develop relationships with potential customers through online channels like social media or direct outreach programs that build brand recognition while tapping into existing customer bases as well as reaching out to prospects who may be interested in their offerings.

Liquidation

Liquidation, as a type of corporate level strategy, is the process of selling off or closing down all of a company’s assets in order to pay creditors and dissolve the business. This strategy is usually employed when a company has run out of options for salvaging its financial situation; it allows them to recoup some cash from its investments rather than just letting those assets languish. Liquidation also helps protect shareholders’ interests by allowing them to receive at least some compensation for their investment.

The primary disadvantage of liquidating a business is that it often results in job loss, which can be very difficult financially and emotionally for employees. Many companies will try other strategies before opting for liquidation, such as downsizing, restructuring debt obligations and finding new sources of financing prior to taking this drastic step.

The specifics involved in any given liquidation depend on the legal structure under which the company operates (corporations have different rules than partnerships) and local laws governing insolvency proceedings. Businesses must understand these regulations to make an informed decision about whether or not this option makes sense for their particular circumstances.

Concentration

Concentration is one of the characteristics of corporate level strategies. It refers to a company’s decision to focus its efforts and resources on specific areas or markets to maximise profit potential. Companies may choose to concentrate their efforts on certain product lines, geographical locations, customer segments or even industry sectors. This type of strategy allows them to gain an edge over competitors by focusing on areas where they can achieve greater economies of scale and cost efficiencies, as well as stronger market share and better brand recognition.

Concentrating corporate-level strategies can help organisations stay ahead by leveraging existing strengths and taking advantage of opportunities presented when competition is low. y concentrating on these areas, companies are able to increase their return on investment while reducing risk by limiting exposure to other markets that may be more volatile. Additionally, this type of strategy also provides an opportunity for growth through increased investments into the chosen area or market segment since it already has a strong foothold within its core industry sector.

What is the Framework of Corporate Level Strategies?

The corporate-level strategy framework comprises four distinct elements: vision and mission, objectives and goals, core competencies, and strategic positioning.

Vision and Mission: These two fundamental components of the strategy provide the overall direction for an organisation. The vision defines what a company wants to become in the future, while the mission outlines how it will achieve its desired end state.

Objectives and Goals: Corporate-level objectives are typically based on long-term plans involving multiple organisational departments or functions. Goals set specific targets for each objective that can be objectively measured by management or other stakeholders to track progress over time.

Analysis of Internal Resources: Corporate strategies must consider an organisation’s existing resources, skills and capabilities to identify competitive advantages or areas of weakness relative to competitors. This includes performing a SWOT analysis (strengths, weaknesses, opportunities & threats) to assess internal assets and limitations comprehensively.

Analysing External Environment: Organisational performance is affected by changes in market conditions, technology advances, industry trends etc., so companies must remain aware of external influences on their operations. Environmental scanning involves monitoring both macro-level variables like economic stability/growth rates & micro-level factors such as customer purchasing habits/preferences.

Core Competencies: Core competencies are unique capabilities or strengths that give a company a competitive advantage in its industry or market segment(s). Identifying these capabilities allows companies to focus resources on areas where they have particular strengths, which can help them gain a foothold in new markets or products more quickly than their competitors can do with similar offerings.

Strategic Positioning: This component involves analysing the current environment, assessing potential threats from competitors, identifying opportunities available to the firm, and determining entry barriers into new markets/products and exit strategies if needed. All are designed around creating sustainable competitive advantages against rivals through the differentiation of products/services offered alongside cost leadership techniques when necessary.

Also Read: Top IIM MBA for Working Professionals in 2023: Choose the Right MBA

Formulating Strategies: Once a firm has assessed its own strengths/weaknesses and identified external environment opportunities/threats, executives must decide how best to position itself relative to competition by selecting appropriate business-level strategies.

Evaluate Impact: The impact of each strategic decision should be monitored using quantitative measures such as return investment ROI) financial ratios e g efficiency, liquidity etc. While these metrics provide useful information, they do not paint the full picture since long-term success depends on qualitative elements, reputation, innovative products etc.

Conclusion

In conclusion, corporate level strategies form the basis of an organisation’s overall strategy and vision. They play a key role in deciding how resources will be utilised to achieve desired objectives and goals. Organisations may use different frameworks for corporate level strategies such as portfolio analysis, diversification or focus on core competencies. The success of any business strategy depends on its implementation at the corporate level.

Check out our Advanced Executive Certificate in Business Management in the Digital Era will help you learn corporate level strategies and management techniques at an expert level. You’ll gain a comprehensive understanding of digital transformation, effective marketing plans, complex project management systems and more. With this certificate, you’ll be able to identify new opportunities, develop effective business solutions and gain a competitive edge. Start taking advantage of all that this cutting-edge curriculum has to offer today! This course will give you the skills to stay ahead of industry trends and make sound decisions for your organisation’s success.

More Information:

Business Development Manager Salary In India 2023

What Are Startup Business Models: How To Choose One For Your Startup?

Top 21 Effective Team Management Skills: Key To Become a Good Manager